All Categories

Featured

Table of Contents

Section 691(c)( 1) supplies that an individual who consists of an amount of IRD in gross earnings under 691(a) is allowed as a reduction, for the same taxed year, a portion of the estate tax paid by reason of the addition of that IRD in the decedent's gross estate. Usually, the quantity of the deduction is calculated using inheritance tax values, and is the amount that bears the exact same ratio to the inheritance tax attributable to the net value of all IRD items consisted of in the decedent's gross estate as the value of the IRD consisted of because person's gross earnings for that taxed year births to the value of all IRD items included in the decedent's gross estate.

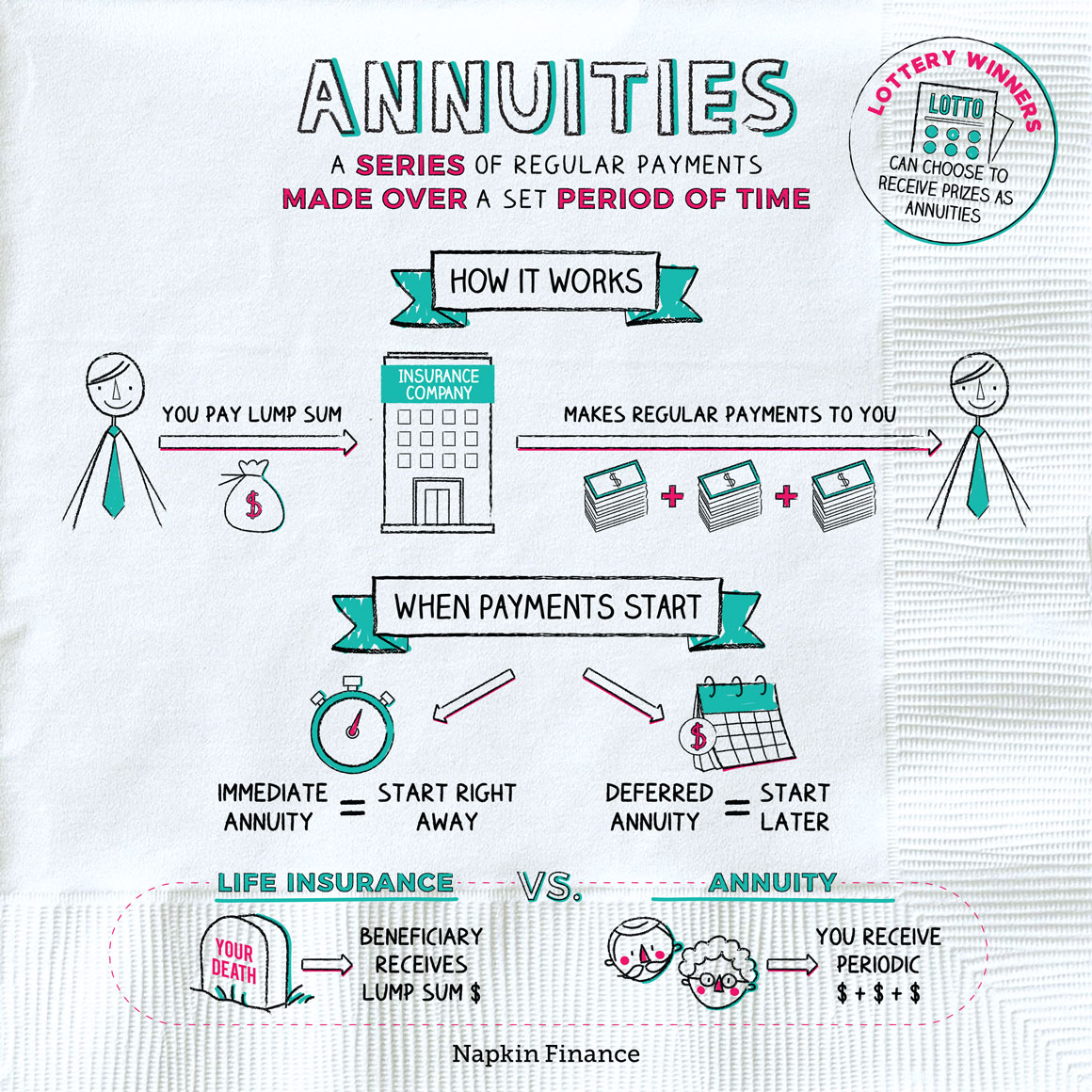

Area 1014(c) offers that 1014 does not apply to home that comprises a right to obtain a product of IRD under 691. Rev. Rul. 79-335, 1979-2 C.B. 292, addresses a circumstance in which the owner-annuitant purchases a deferred variable annuity agreement that offers that if the owner dies before the annuity starting date, the named beneficiary may choose to obtain the here and now collected value of the agreement either in the type of an annuity or a lump-sum repayment.

Rul. If the beneficiary chooses a lump-sum settlement, the excess of the quantity received over the amount of factor to consider paid by the decedent is includable in the beneficiary's gross income.

Rul (Deferred annuities). 79-335 wraps up that the annuity exception in 1014(b)( 9 )(A) uses to the agreement described because judgment, it does not especially deal with whether amounts obtained by a beneficiary under a deferred annuity agreement in excess of the owner-annuitant's financial investment in the contract would certainly undergo 691 and 1014(c). Had the owner-annuitant surrendered the contract and obtained the amounts in unwanted of the owner-annuitant's investment in the agreement, those quantities would have been revenue to the owner-annuitant under 72(e).

Are Fixed Income Annuities taxable when inherited

Furthermore, in the here and now instance, had A gave up the agreement and obtained the quantities at problem, those quantities would certainly have been revenue to A under 72(e) to the level they surpassed A's investment in the contract. As necessary, amounts that B gets that go beyond A's investment in the contract are IRD under 691(a).

Rul. 79-335, those quantities are includible in B's gross income and B does not receive a basis modification in the agreement. However, B will certainly be entitled to a deduction under 691(c) if estate tax was due because A's fatality. The result would be the very same whether B gets the survivor benefit in a swelling sum or as regular payments.

COMPOSING Info The major author of this revenue ruling is Bradford R.

Are Annuity Income Stream taxable when inherited

Q. How are annuities taxed as tired inheritance? Is there a difference if I inherit it directly or if it goes to a trust fund for which I'm the beneficiary? This is a wonderful concern, yet it's the kind you ought to take to an estate planning attorney who knows the information of your situation.

What is the connection between the deceased owner of the annuity and you, the recipient? What type of annuity is this?

We'll assume the annuity is a non-qualified annuity, which indicates it's not part of an IRA or other competent retirement strategy. Botwinick said this annuity would certainly be added to the taxable estate for New Jacket and government estate tax obligation objectives at its date of fatality value.

Tax rules for inherited Annuity Fees

citizen partner goes beyond $2 million. This is called the exemption.Any quantity passing to an U.S. person spouse will certainly be totally excluded from New Jacket inheritance tax, and if the owner of the annuity lives to the end of 2017, after that there will be no New Jacket estate tax on any amount because the estate tax is scheduled for abolition beginning on Jan. There are government estate tax obligations.

"Now, income taxes.Again, we're presuming this annuity is a non-qualified annuity. If estate tax obligations are paid as a result of the addition of the annuity in the taxable estate, the recipient might be entitled to a deduction for inherited revenue in regard of a decedent, he said. Beneficiaries have several choices to think about when picking how to receive money from an inherited annuity.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices Key Insights on Variable Annuity Vs Fixed Annuity Defining Fixed Annuity Vs Equity-linked Variable Annuity Pros and Cons of Various Financial Options Why Choosing

Exploring the Basics of Retirement Options A Comprehensive Guide to Fixed Income Annuity Vs Variable Growth Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Different Retire

Breaking Down What Is A Variable Annuity Vs A Fixed Annuity A Comprehensive Guide to Deferred Annuity Vs Variable Annuity What Is Pros And Cons Of Fixed Annuity And Variable Annuity? Pros and Cons of

More

Latest Posts