All Categories

Featured

Table of Contents

Maintaining your designations up to day can ensure that your annuity will be managed according to your dreams need to you pass away suddenly. A yearly evaluation, significant life occasions can trigger annuity proprietors to take one more appearance at their recipient options.

Just like any type of financial product, looking for the assistance of a monetary advisor can be valuable. An economic coordinator can guide you through annuity monitoring processes, consisting of the methods for upgrading your agreement's recipient. If no beneficiary is called, the payment of an annuity's fatality benefit mosts likely to the estate of the annuity holder.

Inheriting an annuity can be an excellent windfall, but can also increase unanticipated tax responsibilities and administrative problems to handle. In this blog post we cover a couple of fundamentals to be aware of when you inherit an annuity. Understand that there are 2 kinds on annuities from a tax point of view: Certified, or non-qualified.

When you take cash out of an acquired qualified annuity, the total withdrawn will be counted as taxable revenue and taxed at your ordinary revenue tax rate, which can be fairly high depending on your economic circumstance. Non-qualified annuities were moneyed with financial savings that currently had actually taxes paid. You will not owe tax obligations on the original cost basis (the total payments made initially right into the annuity), but you will still owe tax obligations on the development of the financial investments nevertheless and that will still be taxed as income to you.

Specifically if the original annuity proprietor had been obtaining payments from the insurance policy firm. Annuities are normally made to give revenue for the initial annuity proprietor, and afterwards discontinue repayments as soon as the initial owner, and possibly their spouse, have passed. There are a few circumstances where an annuity might leave an advantage for the recipient inheriting the annuity: This suggests that the first proprietor of the annuity was not getting regular settlements from the annuity.

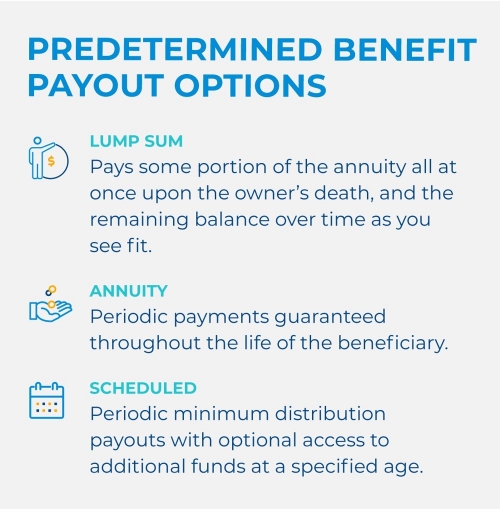

The recipients will certainly have several options for how to receive their payment: They might maintain the cash in the annuity, and have the possessions relocated to an acquired annuity account (Variable annuities). In this instance the properties may still remain invested and proceed to grow, however there will certainly be needed withdrawal guidelines to be knowledgeable about

Is there tax on inherited Lifetime Annuities

You may likewise be able to pay out and receive a round figure repayment from the acquired annuity. Be sure you understand the tax effects of this decision, or talk with a financial consultant, due to the fact that you might be subject to significant income tax obligation obligation by making this election. If you choose a lump-sum payout option on a certified annuity, you will certainly subject to earnings tax obligations on the entire worth of the annuity.

One more feature that may exist for annuities is an assured survivor benefit (Annuity withdrawal options). If the initial proprietor of the annuity elected this function, the beneficiary will be eligible for an once lump sum benefit. Exactly how this is tired will certainly depend upon the kind of annuity and the worth of the death advantage

The details guidelines you should comply with rely on your connection to the individual that passed away, the sort of annuity, and the phrasing in the annuity agreement sometimes of purchase. You will certainly have a collection amount of time that you need to withdrawal the possessions from the annuity after the first proprietors death.

Due to the tax obligation repercussions of withdrawals from annuities, this suggests you require to carefully plan on the ideal means to take out from the account with the most affordable amount in tax obligations paid. Taking a large swelling amount might push you right into extremely high tax obligation brackets and result in a larger part of your inheritance mosting likely to pay the tax obligation costs.

It is likewise crucial to know that annuities can be exchanged. This is called a 1035 exchange and permits you to relocate the cash from a certified or non-qualified annuity right into a various annuity with another insurer. This can be a great choice if the annuity agreement you inherited has high costs, or is simply wrong for you.

Handling and investing an inheritance is exceptionally crucial duty that you will certainly be forced right into at the time of inheritance. That can leave you with a great deal of inquiries, and a great deal of prospective to make costly mistakes. We are right here to aid. Arnold and Mote Wide Range Management is a fiduciary, fee-only economic organizer.

Joint And Survivor Annuities inheritance tax rules

Annuities are one of the lots of devices capitalists have for constructing wealth and protecting their economic health. There are various kinds of annuities, each with its own advantages and features, the vital aspect of an annuity is that it pays either a collection of repayments or a lump sum according to the contract terms.

If you just recently acquired an annuity, you may not know where to begin. That's entirely understandablehere's what you must know. Along with the insurance firm, a number of events are included in an annuity contract. Annuity proprietor: The person that gets in right into and spends for the annuity contract is the proprietor.

The proprietor has complete control over the agreement and can alter recipients or end the contract based on any type of suitable abandonment charges. An annuity may have co-owners, which is typically the instance with spouses. Annuitant: The annuitant is the person whose life is utilized to identify the payout. The proprietor and annuitant might coincide individual, such as when someone purchases an annuity (as the owner) to offer them with a settlement stream for their (the annuitant's) life.

Annuities with several annuitants are called joint-life annuities. Just like numerous owners, joint-life annuities are an usual framework with pairs because the annuity remains to pay the enduring spouse after the very first partner passes. This can provide earnings safety in retirement. Recipients: Annuity recipients are the events to obtain any applicable fatality advantages.

When a fatality benefit is caused, settlements might depend in part on whether the proprietor had currently begun to receive annuity repayments. An inherited annuity death benefit works differently if the annuitant wasn't already getting annuity settlements at the time of their passing.

When the advantage is paid to you as a round figure, you obtain the entire quantity in a single payment. If you choose to obtain a settlement stream, you will certainly have a number of options offered, depending upon the contract. If the owner was currently receiving annuity payments at the time of fatality, after that the annuity contract may simply end.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices Key Insights on Variable Annuity Vs Fixed Annuity Defining Fixed Annuity Vs Equity-linked Variable Annuity Pros and Cons of Various Financial Options Why Choosing

Exploring the Basics of Retirement Options A Comprehensive Guide to Fixed Income Annuity Vs Variable Growth Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Different Retire

Breaking Down What Is A Variable Annuity Vs A Fixed Annuity A Comprehensive Guide to Deferred Annuity Vs Variable Annuity What Is Pros And Cons Of Fixed Annuity And Variable Annuity? Pros and Cons of

More

Latest Posts